Insurance companies conduct business based on the premise that their policies are the last word on whether they pay or deny a healthcare claim. This assumption, however, is false. The ERISA appeals process, little known but landmark federal legislation, can recover money insurance companies owe medical providers and patients for aged claims and denials.

In many cases of claims underpayment or rejection, federal law trumps insurance policies. But appealing claims denials under complex federal laws is simply beyond most patients. So the duty falls on healthcare providers.

Even at the largest hospitals, few financial staff have the expertise to pursue federal ERISA appeals. Innovative revenue cycle directors who do, however, wield a powerful tool for improving hospital cash flow–and with it, patient care. Their most effective leverage on insurance companies is the Employee Retirement Income Security Act (ERISA) of 1974.

Our company, ERISA Recovery, uses this legislation, empowered by data mining and the best industry analysts, to collect money insurance companies owe. And we do it without changing hospital work processes or requiring upfront fees.

History of ERISA appeals

The history of the Employee Retirement Income Security Act (ERISA) dates back to a series of events over 50 years ago that ultimately resulted in groundbreaking legislation to protect employee pension and healthcare plans.

Prior to that, the earliest pension and healthcare regulation focused on rules about the disclosure of benefit plan details and beneficiaries’ personal data. Throughout the evolution of ERISA-related legislation, these disclosure rules became the central principle in healthcare reform. Harnessing the power of patient data is healthcare’s holy grail.

Regulatory landscape before ERISA

The Internal Revenue Service was the first government agency to regulate private pension and healthcare plans. The Revenue Acts of 1921 and 1926 authorized employers to deduct pension contributions from corporate income. This allowed pension fund income to accumulate tax-free. To qualify for such favorable tax treatment, the plans had to meet minimum employee coverage and employer contribution requirements. The Revenue Act of 1942 provided stricter participation requirements and, for the first time ever, disclosure requirements.

The Welfare and Pension Plans Disclosure Act in 1959 (WPPDA) transferred the responsibility of regulating benefit plans to the U.S. Department of Labor. This legislation required plan sponsors, such as employers and labor unions, to file plan descriptions and annual financial reports with the government. The law also required fiduciary agents to provide this information to plan participants. The idea behind such transparency was it would help employees monitor their own pensions and thus prevent mismanagement. (U.S. Department of Labor, “The History of EBSA and ERISA.”)

However, this basic regulation wasn’t enough.

Origins: Studebaker-Packard crisis proves catalyst for strong ERISA appeals

In 1963 the automobile manufacturer Studebaker-Packard defaulted on commitments to employee pensions. No single event in ERISA’s history is more closely linked to the legislation’s creation. The manufacturer’s default on employee pensions became the catalyst for important political reform.

United Auto Workers President Walter Reuther used the default as an opportunity to build public support for “pension reinsurance,” which would protect worker benefits even if their companies went bankrupt. The Studebaker-Packard crisis created the opening for Reuther to move default risk and termination insurance onto Congress’ legislative agenda.

The same year Congress also investigated the Teamster Union’s control of $4,000,000 in pension funds. Investigators found no mismanagement. But throughout the mid-sixties bipartisan congressional representatives sponsored legislation setting guidelines for employee benefit funds.

In 1972 NBC aired a documentary depicting dire consequences on workers from restrictive vesting requirements and corrupt pension plan management. This broadcast reached a large audience and added momentum to growing national concern. Reuther’s proposal inspired the program later created by Title IV of ERISA. (“The Most Glorious Story of Failure in the Business: the Studebaker-Packard Corporation and the Origins of ERISA.” University of Buffalo Law School, 13 Nov 2001.)

In 1974 Congress finally passed the first ERISA legislation to protect employee pension and healthcare plans. Today, a modified version of this program continues to protect workers’ pensions and health insurance. (Pension Plan Termination Fact Sheet.)

By extension, by regulating people or companies acting on behalf of employees’ fiduciary interests, ERISA also protects hospitals that serve policyholders. These regulated fiduciaries include insurance companies.

ERISA protects employees and healthcare providers because it

- Requires the disclosure of financial and other benefit plan details

- Establishes standards of conduct for plan fiduciaries

- Provides legal remedies and access to the federal courts

ERISA requires that insurers provide policyholders with accurate details about their plan’s coverage. The legislation also forbids plan administrators from financial self-dealing. And perhaps most importantly, ERISA establishes a formal process for appealing denied claims, with the last resort being the right to sue for breaches of fiduciary duty. (U.S. Department of Labor. “ERISA.”)

Limitations of ERISA appeals

It’s also helpful to point out ERISA’s limitations. Rather than require employers to establish pension plans or to set a minimum level of benefits, ERISA sets rules for how pension plans must operate once established. In other words, insurance companies must be transparent about benefit plan details and honor the terms spelled out in their policies.

If a plaintiff takes an ERISA claim through federal appeals, the process restricts their legal options in a few ways. First of all, there are no jury trials in the ERISA appeals process. A federal judge examines the case in an administrative hearing. Patients and hospitals also cannot sue for damages for pain and suffering for payment delay; they can recoup only what they’re owed. The lack of consequences for paying hospitals late incentivizes insurance companies to routinely underpay.

Patients’ and hospitals’ rights under ERISA appeals

ERISA does protect certain basic rights for patients and their medical providers:

- Insurance companies must supply a Summary Plan Description (SPD) within 90 days of a beneficiary’s coverage starting.

- ERISA requires plan administrators such as insurance companies to respond within 30 days to requests for plan documents.

- ERISA also has anti-retaliation rules. Section 510 of ERISA prohibits insurance companies from withholding benefits as punishment for participants exercising their rights under ERISA. (Smith Gambrell Russell. “ERISA Litigation basics.”)

In underpaying and denying millions of claims, insurance companies not only violate terms of their own benefit plans, they also violate federal law. Why do insurance companies deny or underpay so many claims? In short, because they can get away with it. And this practice is profitable.

According to the insurance industry’s own research from over 20 years ago, most policyholders denied payment eventually give up on the process of appealing claims rejections: “Individuals facing disputes with their health plans tend not to even contact their plan to resolve problems; when they try to resolve a claim denial or other problem, most people facing such a problem had to attempt a resolution for a month or longer, or they were simply unable to resolve it at all. Even when denials or other problems generate out-of-pocket costs exceeding $1,000 or resulted in a serious decline in health, sixty percent of individuals did not contact their health insurance plan to resolve the problem.” (Memorandum from Jeff McCall to IDC Mgmt. Grp. & Glenn Felton, Oct. 2, 1995.) When a patient’s insurance claim is denied for a procedure a hospital has already performed, the medical institution often must either appeal the decision or absorb the procedure’s cost as a loss.

ERISA Recovery’s proprietary data mining system leads to successful appeals

If a healthcare organization could master data mining of claims denials, this would be powerful leverage in persuading insurance companies to pay what they owe.

This is where our company, ERISA Recovery, fills a market need. Because we have the means to data mine millions of claims denials details, we can establish patterns of contract-breaking underpayment which are impossible for insurance companies to disprove.

Central billing offices should thus take note. The ERISA appeals process creates a powerful tool for addressing aged claims other hospital vendors have failed to collect. Because healthcare institutions have written off many of these cases as “zero balance” or uncollectible accounts, successful ERISA appeals are a fresh source of revenue hospitals can use to protect their bottom lines and patients’ care. After two years of the pandemic straining the healthcare system, discovering the ERISA appeals process could save many hospitals now on the edge of insolvency.

ERISA allows hospitals to go back up to ten years to fight insurance underpayment and denial. Smaller institutions can often recover millions of dollars. Larger hospital systems can reclaim even more. According to the U.S. Department of Labor, the ERISA appeals process applies to insurance policies covering over 135 million beneficiaries. Our company helps level the playing field between healthcare providers and the insurance industry.

Why don’t more hospitals use the ERISA appeals process?

One reason more hospital CFOs don’t pursue ERISA appeals is the legislation is complex. t has been amended repeatedly over the last 50 years. Case law runs tens of thousands of pages. Over the last half-century, courts, government agencies and Congress have all redefined ERISA obligations regulating insurance plans and the rights of healthcare providers to reimbursement. Amendments to ERISA include the most famous ground-breaking healthcare legislation in recent decades.

COBRA expands ERISA by guaranteeing continuity of coverage

Congress passed the Consolidated Omnibus Budget Reconciliation Act (COBRA) in 1985 to protect workers and their families from gaps in healthcare coverage when they lose or change jobs. COBRA builds on ERISA by requiring employers to offer continuation coverage under the employer’s health plan to workers following certain events including voluntary or involuntary job loss, reduction in hours worked, or death of, or divorce from, the covered employee. Under COBRA, a worker or family member can generally keep group health plan benefits for eighteen or thirty-six months, depending on the reason for the loss of coverage.

HIPAA covers pre-existing conditions, protects patient data

Another example of further development of ERISA legislation is the Health Insurance Portability and Accountability Act of 1996 (or HIPAA), which made it easier to change employers without losing coverage for medical conditions, in part by limiting the ability of a new employer plan to exclude pre-existing conditions.

HIPAA also protects certain kinds of patient personal data: “individually identifiable information relating to the past, present, or future health status of an individual that is created, collected, or transmitted, or maintained by a HIPAA-covered entity in relation to the provision of healthcare, payment for healthcare services, or use in healthcare operations.” ( HIPAA Journal. “What Is Considered Protected Health Information Under ERISA?” )

HIPAA defines as protected health information (PHI) “diagnoses, treatment information, medical test results, and prescription information,” as are national identification numbers and demographic information such as birth dates, gender, ethnicity, and contact and emergency contact information. PHI relates to physical records, while EPHI is any PHI that is created, stored, transmitted, or received electronically.” (Ibid.)

HIPAA was passed with the dual goals of making health care delivery more efficient and increasing the number of Americans with health insurance. Three main provisions of the act ensure these goals:

- The portability of health plans and data

- The tax provisions

- The administrative simplification provisions

Behind this move towards standardization of data is the recognition that the healthcare industry mines huge troves of private patient information. Healthcare reformers also recognize that insurance companies use differences in paperwork and administration to rationalize higher middleman fees.

The HIPAA Privacy Rule was created under the act’s third provision. The act’s provisions to simplify paperwork and administrative costs instructed the Secretary of the U.S. Department of Health and Human Services (HHS) to issue regulations on electronic transmission of health information, which mushroomed in the early 1990s.

While the initial impulse behind the bill was to standardize electronic health information, Congress also recognized that advances in digital medical technology already threatened healthcare privacy. Thus, HIPAA mandated the development of national privacy standards to secure protected health information.

Affordable Care Act (Obamacare) and ERISA

Further modifications to ERISA protection include the Affordable Care Act (ACA) and the Women’s Health and Cancer Rights Act.

Formally known as the Patient Protection and Affordable Care Act (PPACA), or simply Obamacare, the ACA expanded the number of people eligible for Medicaid, created health insurance exchanges, mandated that Americans obtain health insurance, and prohibited insurance companies from denying coverage–or charging more–due to pre-existing conditions. It also allows children to remain on parents’ plans until age 26 (U.S. House of Representatives. ‘Compilation of Patient Protection and Affordable Care Act,’ Pages 15, 32, and 179.) ( Office of the Legislative Counsel of the U.S. House of Representatives. “Compilation of Patient Protection and Affordable Care” [As Amended Through May 1, 2010].)

Despite ERISA’s breadth and complexity, one of the biggest advantages if offers employees and hospitals is the ability to appeal written-off claims even though state or insurance-company filing time limits have passed.

Insurance claims denials keep increasing

While healthcare analysts often point to patient bad debt as one of hospitals’ biggest liabilities, a lesser-known fact is that insurance companies make it corporate policy to consistently underpay hospital claims. This tendency has worsened during the pandemic. Claims denials increased 23 percent from 2016 to 2020. ( Change Healthcare white paper. “A Review of National Medical Claim Denial Trends.”) The biggest increase in claims denials also fell, cruelly, on regions with the highest first-wave rates of Covid-19, the Pacific coastal states and the Northeast.

The nation’s largest health insurer, UnitedHealth Group, reported $4.9 billion in profits in the first quarter of 2021–compared to $3.4 billion in the same period in 2020 – a 44% increase. This is after the record windfall insurance companies made the first year of the pandemic. ( Amanda Holpuch, The Guardian. “US health insurers report billions in first quarter as small providers face stress.” May 8, 2021.)

This insurance industry profit gouging comes at a time when hospitals are experiencing historic levels of financial stress and millions of Americans struggle to cover health costs. Although the Affordable Care Act requires insurance companies to refund excessive profits, in the short term, hospitals need creative strategies to protect their financial health. This is why the ERISA appeals process is so timely.

An ERISA appeal allows us to re-examine underpaid or rejected claims central billing offices have already written off as uncollectible. Typically we start with the most recent two financial years and then move to prior review periods. Because ERISA is federal law, it supersedes payer contracts and state law in most cases.

Our process can increase your hospital’s revenue at a time when all healthcare systems are under financial stress. How do we do it? Because we’ve been in the ERISA appeals business for over a decade, we’ve developed a powerful system for overturning denied claims and recovering claims underpayments.

The process starts out by establishing basic facts, such as the details of healthcare plans’ coverage. We then import plan and rejection details into our simple “data-transfer process.”

By using ERISA Recovery, hospitals can avoid the antagonism between providers and insurance companies that inevitably escalates during lawsuits.

ERISA appeals process is a powerful tool for recovering hospital bad debt

Turning to the ERISA appeals process can have a profound impact on a hospital’s bottom line. Insurance companies bank on the idea that most hospitals’ billing offices overlook this powerful tool for recovering hospital bad debt. ERISA is, however, one of the most underutilized healthcare revenue solutions. Hospitals use it in less than one percent of all appealed claims denials.

Few medical institutions file ERISA appeals due to process complexity

While regulation of the healthcare insurance industry is complex in general, the ERISA process must follow thousands of pages of case law. Congress and the courts have redefined and clarified ERISA repeatedly over the last five decades. Although staff in hospitals’ central billing offices handle denied claims daily, few revenue cycle managers have any training in the most powerful tool hospitals can use to correct underpayments from insurance companies.

Outsourcing to a specialist firm more effective than in-house appeals unit

Should large hospitals train staff to handle ERISA appeals in house?

This would require both time and money. And the investment is lost with staff turnover. So it makes sense to outsource ERISA claims to a specialist firm like ERISA Recovery.

Why turning to ERISA Recovery is a better option than lawsuits

Another option for recovering claims underpayments is for a hospital to employ an attorney. This more confrontational method of appealing an ERISA claim can sour the relationship between a hospital and insurance companies.

“ERISA Recovery understands hospitals have long-term relationships with insurance companies, so we try to use an educational approach in our negotiations with payers,” said CEO Andre Kus. “Healthcare technology firms like ours evolved to address an unmet need in the marketplace. Because we employ former insurance professionals to curate information our patented data-mining process uncovers, we can often obtain full payment without incurring legal costs and acrimony.”

That’s why the best solution is for healthcare providers to reach out to our company, ERISA Recovery, before writing off insurance company debt.

Our approach to the underpayment recovery process compliments rather than replaces what your hospital is already doing to chase insurance companies’ bad debt. Hospital financial staff can continue the traditional claims-rejection appeals while our team starts our unobtrusive process.

No upfront costs on our ERISA appeals process

We require no retainer or prepayment to start the appeal. We send our data management team out to your medical institution, where they input your hospital’s claims forms, policies and all the data related to rejected or underpaid claims.

We then begin the process of using a proprietary data-mining program to allow our system to find patterns of claims denials and underpayments. These patterns are the fingerprints in our investigation. Insurance companies often follow predictable modus operandi in claims rejections. So when we find one wrongfully denied claim, we often find an entire trove.

Our industry-seasoned staff curate the process. They also use their substantial experience to educate insurance companies how their claims underpayments violate federal law. Then it becomes a process of negotiation based on facts and evidence.

How expensive is ERISA Recovery’s appeal process compared to a lawsuit?

This process is far less expensive and adversarial than a lawsuit and typically yields more consistent success. Contingency-based lawsuit fees start at 33 percent, before expenses, which can rapidly escalate. And even when lawyers win settlements, they often negotiate the claim’s value down to 30 or 40 cents on the dollar. Claims appeals involving attorneys are eight times more expensive, according to the California Workers’ Compensation Institute. (Bob Young. Press release for California Workers’ Compensation Institute. “CWCI Analysis Measures Attorney Involvement In California WC.” February 5, 2014.)

How does the ERISA appeals process work?

ERISA standards require insurance companies to give participants basic, important information about the plan called a Summary Plan Description (SPD).

“The plan administrator is legally obligated to provide to participants, free of charge, the SPD. The summary plan description… tells participants what the plan provides and how it operates… [and] when an employee can [join] the plan and how to file a claim for benefits.”

If an insurance company changes their plan’s terms, they must inform participants, either through a revised summary plan description or in a separate document, called a summary of material modifications. Insurance companies must provide these summaries of changed terms to participants free of charge.

“Plans also must provide a Summary of Benefits and Coverage (SBC) that accurately describes the benefits and coverage under the applicable plan. The SBC is a uniform template that uses clear, plain language to summarize key features of the plan, such as covered benefits, cost-sharing provisions and coverage limitations. Plans and issuers must provide the SBC to participants and beneficiaries at certain times (including with written application materials, at renewal, upon special enrollment and upon request). (U.S. Department of Labor. “Plan Information.”)

Plans must also have a fair process for handling rejected benefit claims. This means the insurance company must provide a reasonable explanation, as well as the opportunity to review the decision.

What federal rules must insurance companies follow in claims denials?

If the insurance company denies a claim it must give the reason for the denial in writing.

The explanation must be clear enough for the average beneficiary to understand. The denial letter must include the following information:

- The reasons why your claim was denied

- The specific section of the insurance plan on which the denial is based

- If the insurance company based a claim denial on medical reasons, insurance companies must disclose these reasons as well as the medical professional’s qualifications

- What documents or evidence the insurance company reviewed in determining your claim

- What additional information you need to include in your appeal for the insurance company to reconsider your original claim

- How to correctly submit an appeal

- The deadline to file an appeal

- A description of your rights as an ERISA beneficiary to file a lawsuit to recover the proceeds

An ERISA appeal is the procedure you must follow if your claim for benefits was denied under ERISA law.

In most ERISA cases, you need to file an appeal before initiating a lawsuit against the insurance company. Hospitals should also exhaust the state-level appeals process before turning to federal ERISA legislation. If you attempt to later sue your insurance company without pursuing administrative remedies, your suit may be rejected from consideration.

ERISA establishes enforcement provisions to ensure that plan funds are protected and that employees receive their benefits, even if a company becomes insolvent. Because hospitals and doctors provide healthcare to plan beneficiaries, ERISA protects medical providers’ rights to insurance company payments.

Doctors and hospital systems can improve their institutions’ bottom lines by exploring claims that are written off after failed appeals at the state level.

How long does ERISA Recovery’s appeals process take?

While getting the ERISA appeals process started is reasonably quick, we commonly work claims for a year or more before we have exhausted the revenue recovery process. Our case studies can provide examples of the process’s timelines.

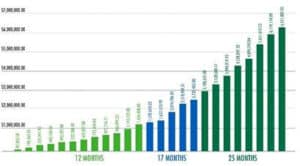

In our first case study, a 13-hospital system client asked for our help recovering claims denials and underpayments. After entering their data into our platform, we were able to recover $87,003 the first month, with substantial increases in the next three quarters. One year later, that total had reached $1,4334,408. But that’s when the growth in recovery took off. Twenty-five months into the project, we had recovered $6,551,887, with another $7.7 million under appeal and $14.8 million being vetted.

In our second case study, we input our client’s data into our platform in August of 2020, just as Covid-19 was making business difficult for hospitals. We won our first ERISA appeal in just three weeks. By the end of the month, our company had recovered $141K. That total rose to $264K by the end of the second month, then $702K at the end of the third month. By the end of the fourth month, the recovery totaled $1.1 million.

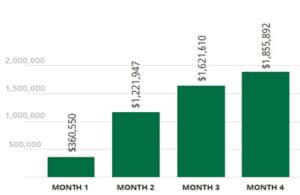

In our third case study, our client was just about to change their electronic medical record-keeping to another system. Beyond the difficulty of adapting to a new platform was the fact that they almost lost substantial numbers of aged claims that wouldn’t transition to their new system. We quickly assisted them by uploading their claims data and payer contracts. We ended up recovering $360,550 the first month, $1.22 million by month three, and $1.62 million for month four, and $1.85 million by month five.

Contact ERISA Recovery today and learn how we can get the process started for you, at no risk and with zero upfront costs. Let us help you seize this opportunity to bring in revenue.

The only risk you face is not acting.

It’s your money!